Japan is a popular target for regional and international capital.

Foreign investors almost doubled their investment from a year ago to $2 billion in the first quarter of the year, according to latest data provided by CBRE: Total foreign investments into Japan’s real estate market has risen 45% in the first half of 2023, compared to the same period last year.

The solid rebound in Japan’s tourism sector following the ease in border restrictions has sparked a rise in hotel occupancies and hospitality investments, Knight Frank said in a recent September note. In July (2023), Japan saw the highest number of foreign travelers since the Covid-19 pandemic.

Knight Frank’s note continued…

“Given the limited availability of new hotel rooms in the foreseeable future, the upward trend in occupancy rates is anticipated to continue,”

In addition, hospitality investments were given a sharp boost following the green-lighting of the construction of Japan’s integrated resorts in Osaka, which would mark the country’s first casino. The project is aimed at drawing both international tourist and domestic spending. ¹

Christian Mancini, chief executive, Asia Pacific ex-China at Savills says: “Although an outlier in the region, the Bank of Japan’s policy to maintain low interest rates has resulted in a very strong investment market both for domestic and cross-border investors.”

So far, 2023 has been rather grim for real estate investment, with transaction volumes falling worldwide due to rising interest rates and fears over the economic outlook. However the Asia Pacific real estate market boasts an important positive point.

Despite regional transaction volumes falling 42% year on year to $62 billion in the first half of this year, cross-border investment by Asia Pacific players rose marginally compared with the first half of 2022, to $11.8 billion, MSCI Real Assets reports. ²

Although commercial real estate transaction volume declined by 20% y-o-y globally in 2022, investment

volume in Japan remained largely unchanged, with only a 2% fall from the previous year. This resilience was

largely due to the Bank of Japan (BoJ) maintaining its easy monetary policy, in contrast to most of the other

major central banks pursuing a monetary tightening policy to counteract inflation.

Despite the weaker yen, Japan has opted to maintain negative interest rates. While the Bank of Japan (BoJ) has made slight adjustments to its yield curve control target, market consensus is that the BoJ will increase central policy rates in H1 2024. Cap rate spreads in Japan are expected to narrow on the back of rate rises.

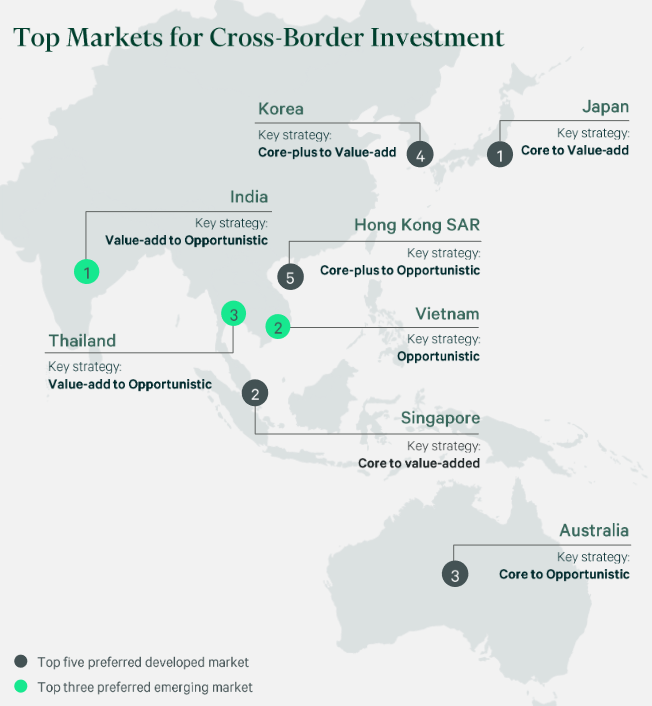

Japan retained its position as by far the most preferred country for cross-border real estate investment for a fifth consecutive year, with Tokyo, Osaka and regional cities the focus as investors remained attracted to the prospect of low cost of debt and stable income streams. ³

Citations:

1 – https://www.cnbc.com/2023/10/04/japans-property-sector-foreign-investments-soared-45percent.html

2 – https://www.savills.com/prospects/themes-still-hungry-regional-investors-keep-buying-asia-real-estate.html

3 – https://www.cbre.com/insights/reports/asia-pacific-investor-intentions-survey-2024

Pingback: We know you want to travel to Japan… Because everybody does! – MSK Property by Type II