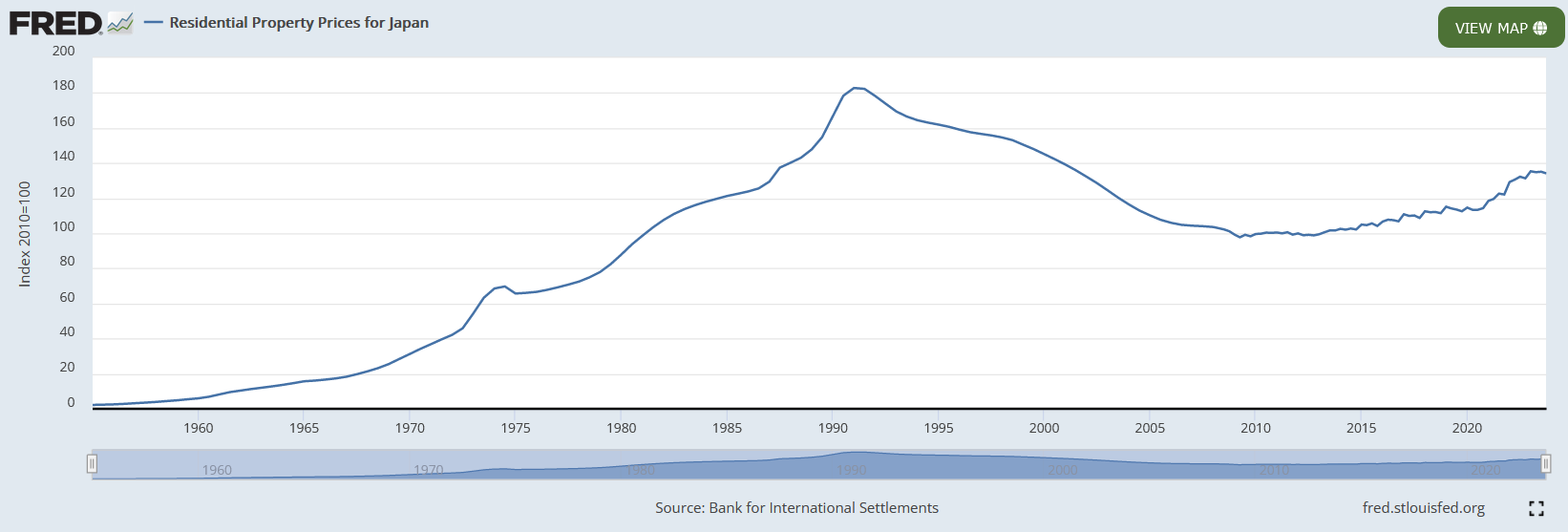

The Japanese real estate market is as diverse as it is complex. With its rich history, the market has undergone various transformations, emerging as a beacon of resilience and opportunity. The urban sprawl of cities like Tokyo, Osaka, and Yokohama offers investors a wide range of investment opportunities, from residential apartments to commercial skyscrapers, each with its own set of advantages.

Current Market Trends and Performance

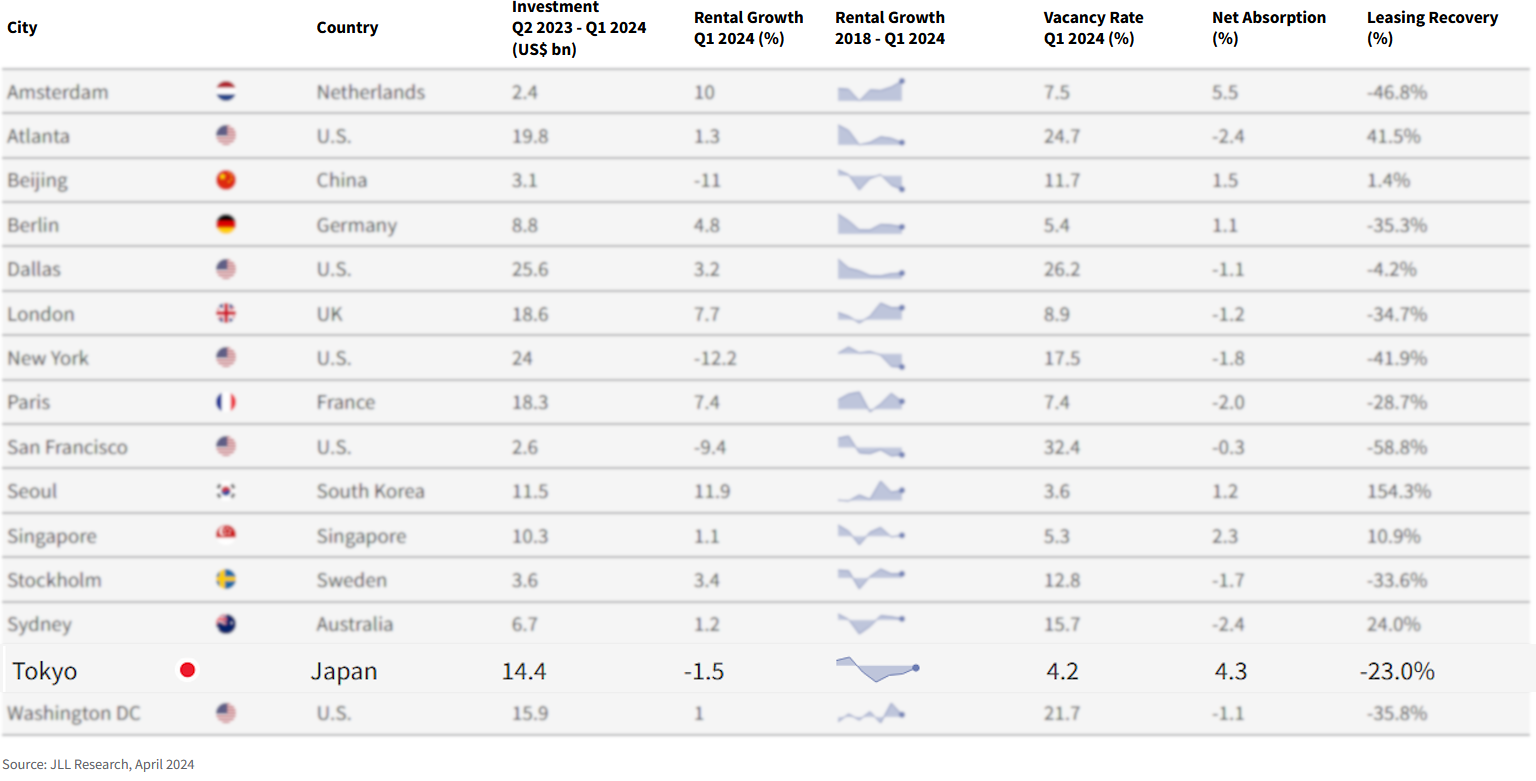

Real estate deal activity in Japan has been among the strongest in the world this year, buoyed by its interest rate policy that has been widely credited for keeping its real estate resilient. Investors deployed $8.9 billion into the country’s commercial real estate sector in the first quarter of the year, up 43% from the year earlier, according to JLL data. A major driver was the burgeoning appetite of foreign investors, who almost doubled their investment from a year ago to $2 billion in the quarter.

“Foreign investors have been actively trying to enter Japan because of its favorable interest rate differentials over other key markets,” says Koji Naito, Research Director, Capital Markets, Japan, JLL. While the weak yen has been a boon for investment, “Japan’s strong fundamentals remain the primary appeal for investors injecting capital into the country.”

Japan’s standout performance this quarter has contrasted with the rest of the world. Investment volumes in the Americas region and Europe declined 61% and 58% year-over-year to $66 billion and $35 billion, respectively, according to data from JLL’s Global Real Estate Perspective.

Key Investment Drivers

- Interest Rate Policy: Japan’s favorable interest rate policy continues to attract foreign investors, offering a stable and low-cost financing environment.

- Currency Advantage: The weak yen has provided an added incentive for foreign investors, making Japanese real estate more affordable compared to other key markets.

- Strong Fundamentals: Despite global economic uncertainties, Japan’s economic stability, robust legal framework, and high-quality infrastructure remain major draws for investors.

Emerging Trends

The Japanese real estate market is not static; it’s shaped by trends that offer new opportunities for investors:

- Remote Work: The rise of remote work has increased demand for residential properties outside major urban centers, presenting new investment opportunities in suburban and rural areas.

- Tourism Growth: The growth of the tourism sector has spurred investment in hospitality and retail properties, as Japan continues to be a top travel destination.

- Technological Innovations: The integration of technology in real estate, such as smart homes and AI-driven property management, is creating new avenues for investment.

The Japanese real estate market, with its unique blend of cultural heritage and modern dynamism, presents a compelling case for investors. By tapping into this market, investors not only gain access to a realm of stability and potential growth but also become part of a forward-thinking economy that continues to innovate and evolve.

For those considering diversifying their investment portfolio, the time is ripe to explore the untapped potential of Japanese real estate. Leap and discover what the Land of the Rising Sun has in store for you.

Get in touch with our team today, e-mail: directors@mskproperty.com…