In the dynamic realm of Japanese commercial real estate, where innovation meets tradition, the landscape is shifting. As we peer into the future, armed with comprehensive data, let’s unravel the projected trends that will shape the narrative of commercial properties in the Land of the Rising Sun.

Defining Commercial Real Estate:

Commercial real estate, the backbone of business activities, encompasses a spectrum of properties – from the towering office buildings that dot the skyline to the bustling retail spaces, warehouses, and industrial hubs. These spaces not only mirror economic vitality but also hold the key to future investments and strategic endeavors.

The Value of Commercial Properties:

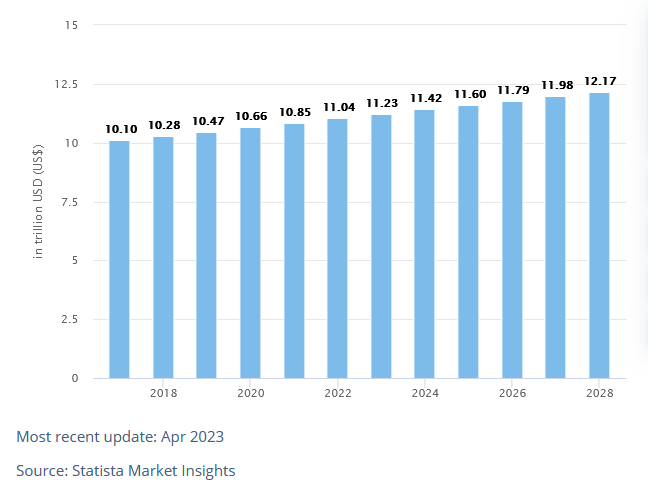

At the heart of our analysis lies the value of commercial properties, a vital key performance indicator reflecting the market’s pulse. Our data projects a formidable worth of ¥US$11.42 trillion in Japan’s commercial real estate market by the year 2024, setting the stage for an exciting journey ahead.

A Closer Look at the Numbers:

The numbers speak volumes about the anticipated growth in Japan’s commercial real estate market. With a projected annual growth rate (CAGR 2024-2028) of 1.60%, we anticipate witnessing a robust market volume of ¥US$12.17 trillion by the year 2028. These figures underscore a promising trajectory for investors eyeing the Japanese commercial real estate sector for strategic investments.

Foreign Investment and Multinational Expansion:

Fueling this surge in market value is the insatiable demand sparked by foreign investment and the expanding footprint of multinational corporations. As global players recognize the strategic advantages presented by Japan’s business landscape, the commercial real estate market becomes a canvas for growth and opportunity. This trend is reshaping the landscape, creating a ripple effect that touches various segments of the market.

A Glimpse into Economic Factors:

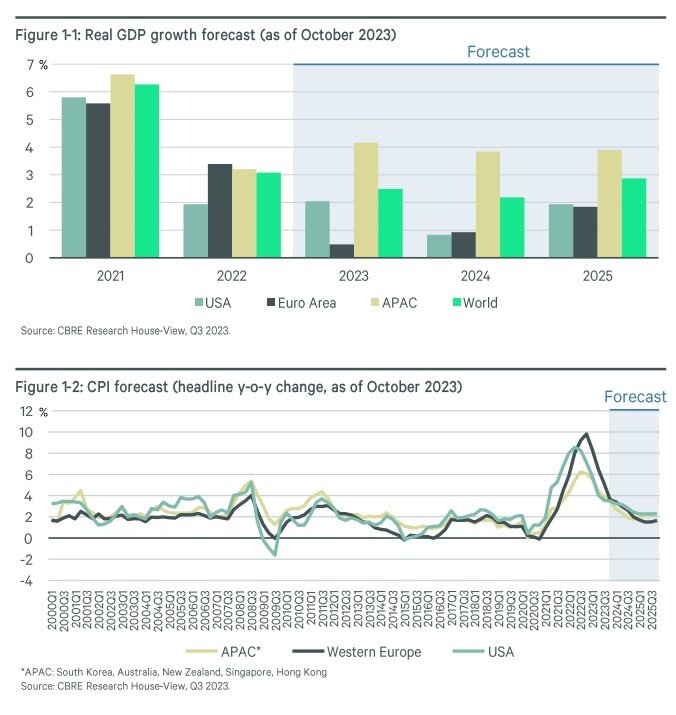

According to new data from CBRE, consensus forecasts predict moderate growth of around 1% per annum in the Japanese economy for 2024 and beyond. Capital expenditure is on the rise, propelled by robust corporate earnings, with key industries like semiconductors and automotive expected to drive exports. Inbound tourist spending is set to grow further, driven by the return of Chinese visitors.

Logistics: Navigating the 2024 Problem

A significant highlight is the surge in demand for logistics facilities, surpassing 1 million tsubo (3,305,785.12 m²) across Japan’s major metropolitan areas in 2023. This growth is driven by concerns over the “2024 problem” and a strengthening of manufacturing supply chains. Despite abundant new supply, CBRE anticipates stable or slightly reduced vacancy rates in major cities.

The retail sector, particularly the coveted Ginza high street, experiences robust demand from various retailers. However, the supply-demand balance is tightening, leading to a 7.9% year-over-year rise in rents in Q3 2023, returning to pre-pandemic levels. CBRE foresees a steady climb in rents, emphasizing the scarcity of prime locations.

The projected trends in Japan’s commercial real estate market unveil a landscape ripe with opportunities and challenges. As investors navigate this horizon, the interplay of foreign investment, multinational expansion, and economic factors provide a roadmap for strategic decisions. The Japanese commercial real estate market stands poised for growth, promising an exciting journey for those ready to seize the opportunities that lie ahead.